Written by Lesley Murray, Spectrum Enterprises

HUD has announced the 2020 income limits for the MTSP housing programs effective April 1, 2020. This includes low income housing tax credits and tax exempt bond financing. HUD allows for a 45 day grace period, which means these limits must be in use by May 15, 2020.

Our advice to all housing professionals is to immediately check for an increase for your sites. If the income limits in your area have increased go back through any files denied over the past few months to see if any slightly over income households may qualify under the new limits.

To find your 2020 income limits visit this site (and make sure to bookmark it!):

https://www.huduser.gov/portal/datasets/mtsp.html

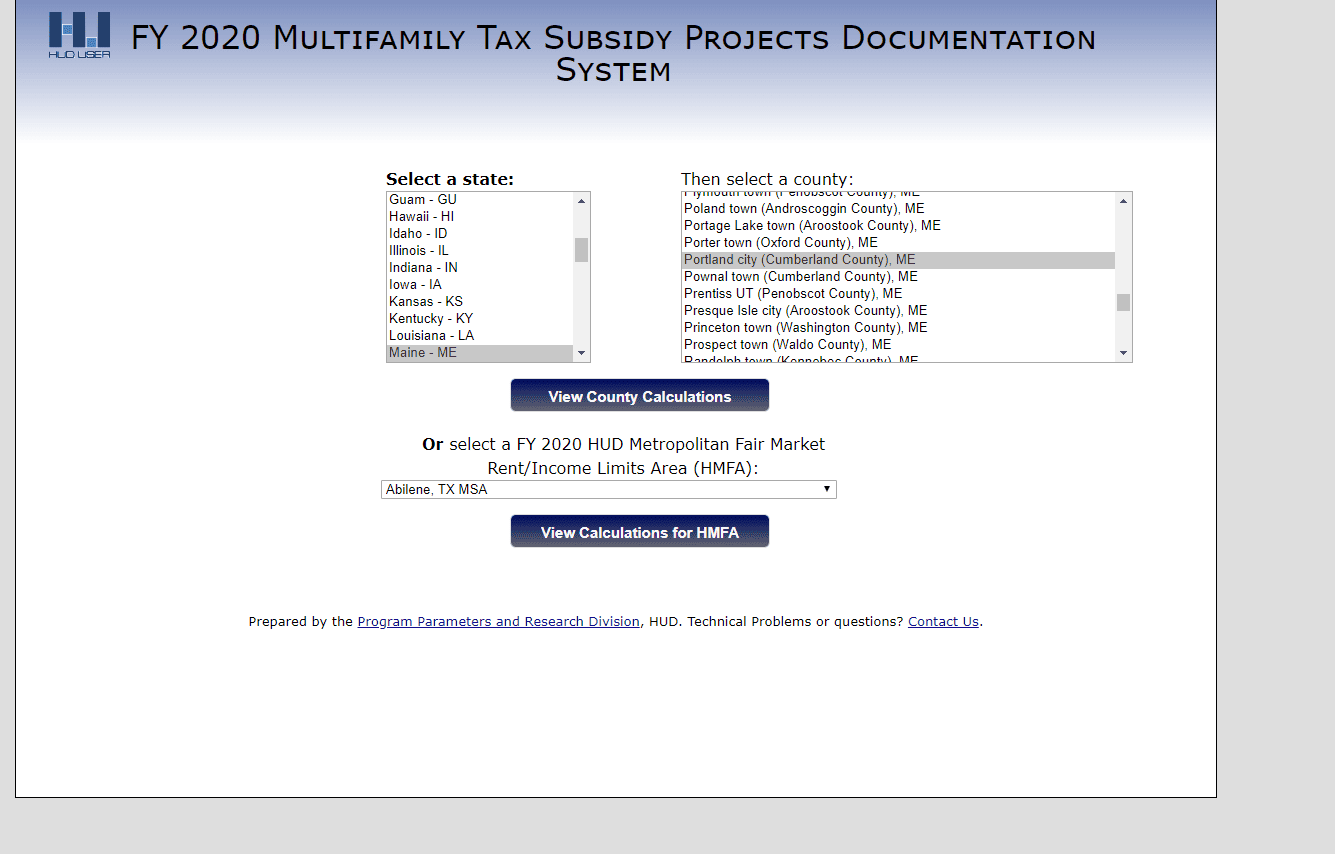

Choose FY2020 MTSP Income Limit Documentation System then click on the grey button on the next page.

On the next page choose your state and then your county or city.

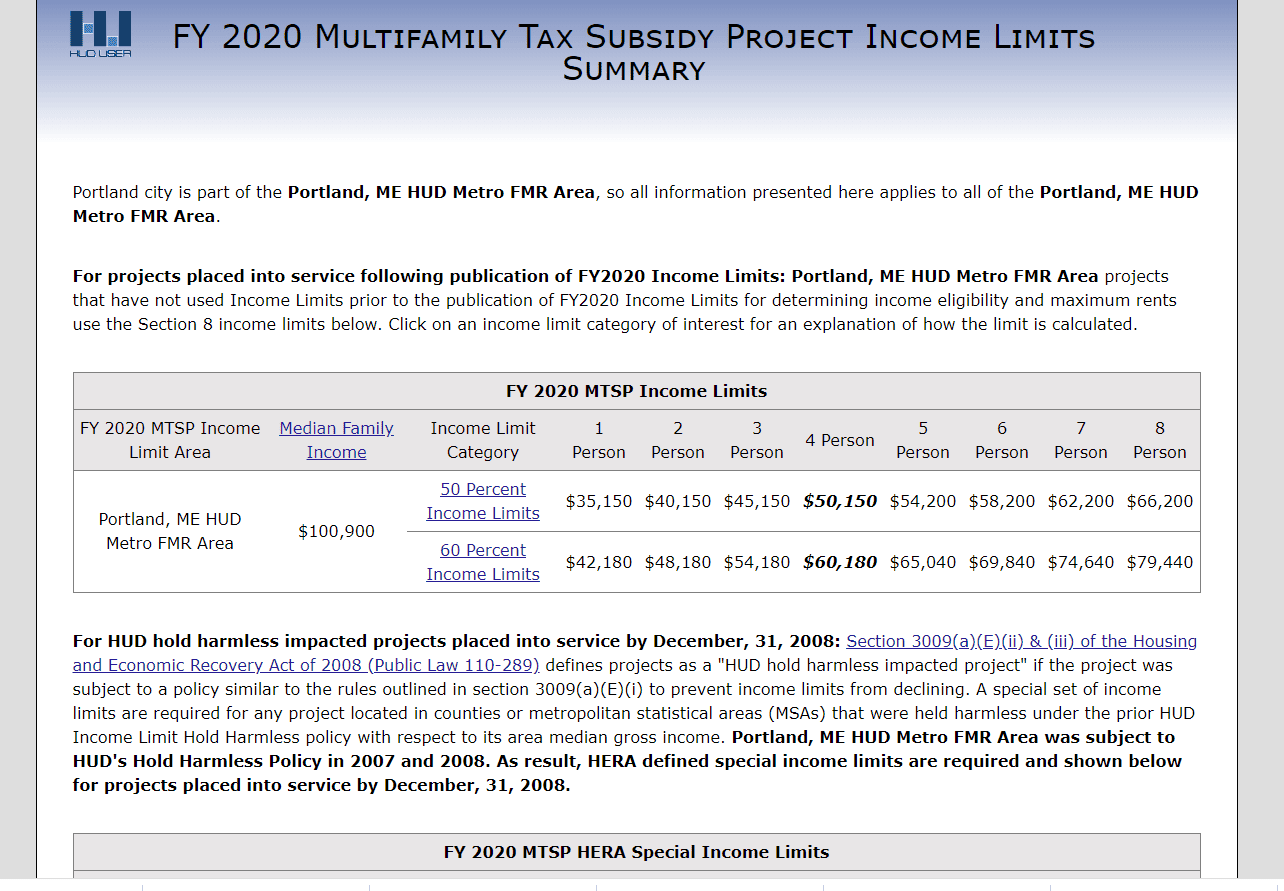

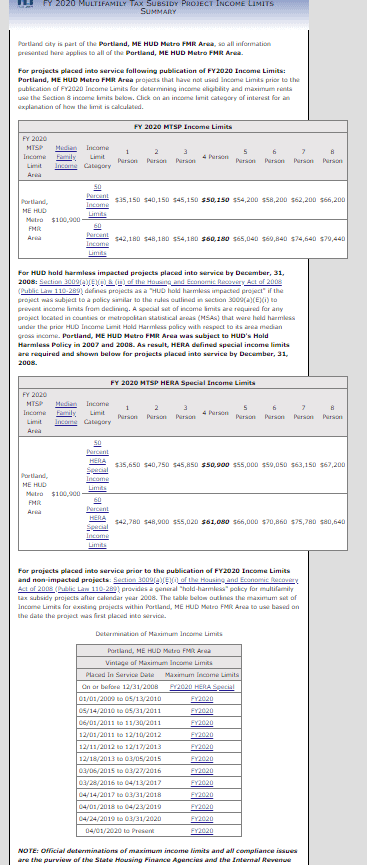

The result will look something like this:

Depending on the placed in service (PIS) date for your project you will use either the HERA special limits (top chart) or the FY (Fiscal Year) limits on the bottom chart. Or you could be held harmless to a prior year.

HUD provides the 50% and 60% income limits. HUD does not provide rent limits or limits for lower set asides such as 40%. Spectrum has created an Excel spreadsheet, see LIHTC Income & Asset Worksheet under Spectrum resources page (***Spectrum Forms***) to accomplish this. After you download the spreadsheet you can enter the placed in service date for your project; the State; the city/town/county; and then you enter the 50% income limits from the HUD page into the yellow shaded line in the spreadsheet. Formulas written into the spreadsheet will calculate the 40% and 60% income limits along with all corresponding gross rent limits.

If you want to manually calculate your rent limits this is the formula:

- 0BR: (1 person income limit x 0.3)/12

- 1BR: (1.5 person income limit x 0.3)/12

*1.5 person income limit = (1 person + 2 person)/2 - 2BR: (3 person income limit x 0.3)/12

- 3BR: (4.5 person income limit x 0.3)/12

*4.5 person income limit = (4 person + 5 person)/2 - 4BR: (6 person income limit x 0.3)/12

We frequently see properties using the incorrect income and rent limits. There is a lot of confusion surrounding this. Fortunately, there are many resources available to provide guidance.

- This blog (originally posted in December 2012) provides guidance on what to do if income limits in your area have decreased.

- This blog (originally posted in January 2013) provides good explanation on choosing the correct income limits based on the building placed in service date.

- IRS newsletters #47, 48, and 50 all contain helpful guidance on how to correctly apply income limits.

As a final note, we always suggest updating your utility allowances at the beginning of the year or when new income limits are published. If you are not sure how to determine the correct UA for your property please refer to Chapter 18 of the 8823 Guide.