Hello all,

Spectrum Compliance is the authorized delegate for the West Virginia Housing Development Fund for the LIHTC, HOME, HTF and RD538 programs in the state of West Virginia. This email is to provide updates and clarification to program monitoring and has been sent to you as an administrator of one or more of these programs. We encourage you to share this information with all managers, leasing agents and compliance officers of your agency.

Updated TIC

Beginning 1/1/26 the LIHTC, HOME, HTF and RD538 programs will begin using the updated LIHTC TIC attached. The former HOME certification will be phased out on December 31, 2025. Certifications that have already been completed as of this notice date do not need to be corrected. Findings will not result from a failure to use the updated TIC at this time.

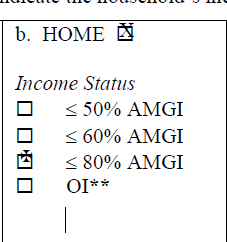

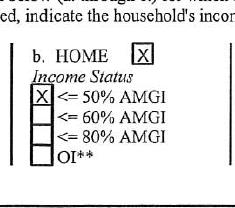

HOME/HTF Designations

Your property HTF and HOME Program set asides will be completed under Part VIII. Program Type on the second page of the TIC (see examples below).

High HOME-

Low HOME-

HTF-

To provide clarification regarding program requirements, please review the following:

LIHTC/RD538 Requirement Clarification

LIHTC Move in files –

- An application (or application update) that includes student status questions must be completed within 120 days of move in certification effective date.

- It is recommended you use the forms listed on the Forms page of the Spectrum website; however, it is not required. Please be certain all required questions are in your application/application update document.

- VAWA 91067 Lease Addendum is a required form for LIHTC move in files.

- Required forms include:

- TIC

- Application (Application Update) document within 120 days of cert effective date.

- Income and Asset Verifications or Self Certifications, where applicable

- Clarification records, where applicable

- Lease

LIHTC Recertifications –

- An annual document (i.e. application update, annual questionnaire, income and asset statement) that asks tenants the required questions regarding all income, all assets, student status, and household composition must be completed within 120 days of the certification effective date.

- Spectrum recommends the Eligibility Checklist on the Forms page of the Spectrum website.

- Required forms include:

- TIC

- Application (application update aka eligibility checklist) document within 120 days of cert effective date.

- Income and Asset Verifications or Self Certifications, where applicable

- Clarification records, where applicable

LIHTC Self Cert/Short Cert

- Self Certifications can be completed for 100% LIHTC properties on the 2nd year annual after move in (see attached).

- Student status still needs to be documented.

HOME/HTF Requirements

HOME/HTF Move in files –

- An application (and application update, if applicable) completed within 120 days of move in certification that includes student status questions listed on the attached Student Rules document.

- It is recommended you use the forms listed on the Forms page of the Spectrum website; however, it is not required. Please be certain all required questions are in your application/application update document.

- Required forms include:

- TIC

- Application (Application Update) document within 120 days of cert effective date.

- Income Verification (2 months’ source documents)

- Asset Verifications or Self Certifications, where applicable

- Clarification records, where applicable

- Lease

- HOME/HTF Lease Addendum

- VAWA 91067 Lease Addendum

HOME/HTF Recertifications –

- An annual document that asks tenants questions regarding all income, all assets, student status questions listed on attached Student Rules document, and household composition is required.

- Spectrum recommends the Eligibility Checklist on the Forms page of the Spectrum website.

- Required forms include:

- TIC or self cert

- For Full Cert – Application Update (Eligibility Checklist) document within 120 days of cert effective date.

- For Full Cert – Income and Asset Verifications

- Student Status documentation within the file

HOME/HTF Self Cert/Short Cert –

- Self Cert/Short Certs can be completed at 1st year annual after move in (see attached).

- When using a self cert/short cert, a full certification with all verifications needs to be completed every 6th year of the project affordability period. The HOME Written Agreement for the property will show the affordability period beginning year. This document will need to be provided at the time of monitoring.

- Student status still needs to be documented.

- Please keep in mind LIHTC rules apply if there is program layering.

HOTMA

Currently, the final implementation date for HUD’s HOTMA provisions is January 1, 2026. Spectrum will continue to extend the implementation date requirement if HUD extends this date.

HOTMA (Housing Opportunity Through Modernization Act of 2016) can be implemented now in West Virginia for the LIHTC, RD538, HOME and HTF programs. In the interim timeframe, any HOTMA related issues found during monitoring will be noted as a Procedural Issue unless the household is found to be ineligible.

If you are unfamiliar with HOTMA and its new requirements for the LIHTC, HOME, HTF and RD538 programs, please obtain training or read the guidance from HUD. https://www.hud.gov/hud-partners/multifamily-hotma

Please note that partial HOTMA implementation is not permitted. Spectrum auditors will ask if HOTMA has been implemented on the property at the time of monitoring via the Site Review Form. Please be sure this information is accurately provided.

For programs other than those listed in this email, please reach out to that Agency for HOTMA implementation guidance.

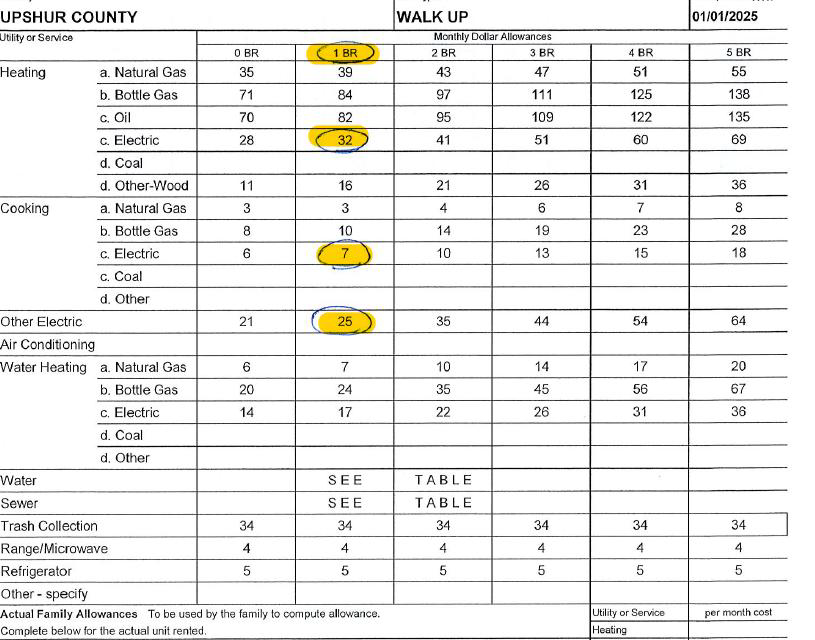

Utility Allowance Source Documentation

- During a monitoring review, Spectrum will request a copy of the utility allowance source documentation for your property.

- Management generated worksheets are not source documents. The source documentation is the agency to which your utility allowance amounts came from (local housing authority, HUD, Rural Development, individual study, etc).

- UA Source Documentations is a requirement for Spectrum to determine the correct utility allowance amounts are being used.

- The utility allowances are required to be updated annually.

- We will need the property to clearly indicate which utilities are tenant paid for each property (or unit if different). See example below:

We are pleased to work with everyone on these changes and encourage any questions you may have. We welcome and encourage you to ask questions which can be directed to [email protected] or [email protected].

Sincerely,

The Spectrum West Virginia Team

Other Helpful information

Link to Spectrum’s forms: https://spectrumlihtc.com/resources/

West Virginia HOME/HTF income and rent limits:

https://www.wvhdf.com/programs/the-home-investment-partnerships-program

https://www.wvhdf.com/programs/national-housing-trust-fund-program

West Virginia HOME and VAWA 91067 Lease Addendums:

https://www.wvhdf.com/mulitfamily-compliance-documents/home-compliance-documents

COLA 2026: 2.6%

Asset Self Cert Limit 2026: $52,787

Imputed Asset Income Rate 2026: 0.40%

STUDENT RULE INFORMATION

LIHTC/RD538 Student Rule Exceptions:

- Households cannot be entirely comprised of full-time students unless one of the following exceptions apply. Households will all full-time students must be asked these questions:

- A student receives assistance under Title IV of the Social Security Act ( the Temporary Assistance for Needy Families (TANF) program)

- A student was previously in the foster care program

- A student is enrolled in a job training program and receiving assistance under the Job Training Partnership Act or under other federal, state, or local laws

- A household comprises of single parents and their children. Such parents must not be dependents of another individual, and the children must not be a dependent of another individual other than their parent. None of the tenants (parents or children) can be dependents of a third party

- The household is comprised of a married couple entitled to file joint tax returns

HOME/HTF Student Rule Exceptions:

Students are not eligible unless an exemption applies. All full-time and part-time students must be asked the following questions:

- Are they 24 years of age or older

- Are they a US military veteran

- Are they married

- Are they a dependent child living with the student

- Is a person with disabilities receiving Section 8 assistance as of 12/30/25.

- Is the student (or student’s parents) eligible to receive Section 8 Assistance

- Is the student able to prove financial independence from their parents

*Note: Regardless of eligibility, monies received from student-related assistance will need to be evaluated to see if it counts as household income. The rules change based on whether HOTMA has been implemented.